The German Federal Parliament passed a bill to mandate the opening of the iPhone NFC chip to mobile payment service companies other than Apple Pay. Apple has mentioned that data protection and financial information security could be compromised.

Reportedly, the bill would mandate access to third-party mobile payment services infrastructure that pays a reasonable margin for e-money infrastructure operators without specifically pointing to Apple. It is expected to be implemented early next year in the form of amendments to the anti-money laundering law.

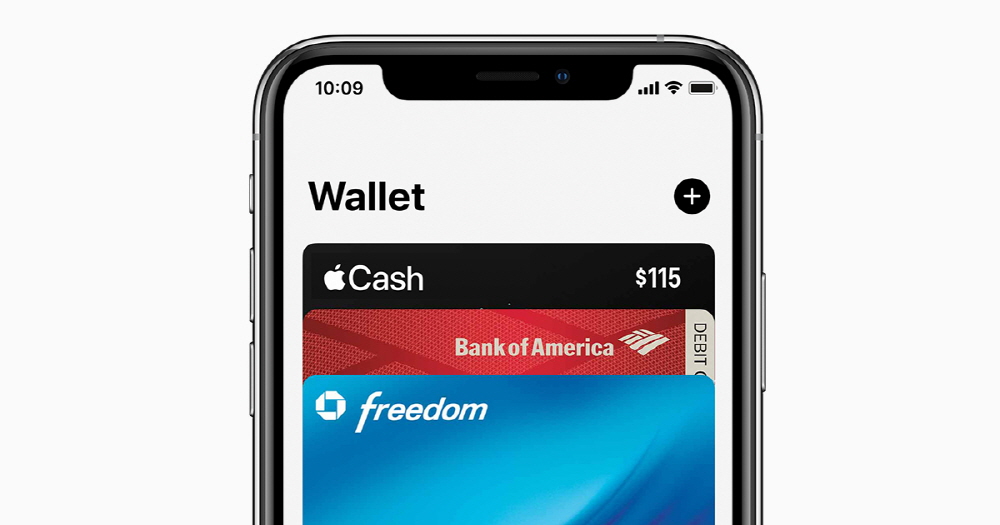

I didn’t specifically mention Apple, but on Android smartphones, all cards and banking apps can access NFC chips. In contrast, iPhone NFC payment only supports cards and payment services added to the wallet app. It can be said that the bill actually struck Apple Pay.

Apple said it was amazed at the sudden introduction of the bill, and said it could be detrimental to user convenience, data protection and financial information security.

But other EU member states may follow Germany’s move. Rumors that EU antitrust regulators are investigating Apple Pay were reported in October. There were testimony that supported Apple Pay’s integration into iOS to remove third-party services, such as urging Apple to install Apple Pay during initial setup of the iPhone, and refusing to bring in wallet apps for competitors’ payment services.

For Apple, Apple Pay is one of the major growth areas. Morgan Stanley also expects payments to reach $190 billion in 2022 and $340 billion in 2027, steadily narrowing the gap with PayPal, the number one online payment industry. Whether Apple will take the lead in online payments, the EU countries may be feeling more of a crisis. Related information can be found here .

Add comment